I attended a conference in Bordeaux last November on the future of en primeur. It was fascinating to hear, in the relative safety of their home turf, the Bordelais accepting the existence of a problem. The overseas notion of heads buried in sand is inaccurate. What is perhaps more accurate, is the lack of any rallying around a joint solution.

There is some movement, as slowly but surely producers start to act, but in isolation. Latour (and Yquem, but to less fanfare) pulled out of en primeur in 2012, and Mouton Rothschild has recently announced it will sell less volume en primeur. Palmer has been saying the same for two years, and this year has identified a different route to market — still en primeur, but cutting out La Place, with the auction at Sotheby’s of an entire barrel. But there have been no concerted measures.

Inertia

Olivier Bernard, President of the Union des Grands Crus de Bordeaux (UGCB), owner of Domaine de Chevalier, stood up and confirmed to the room full of Bordeaux trade and producers, “There’s been a certain amount of inertia with what’s happened over the past five years.” An unsurprising euphemism; Bernard has been critical of so-called “Bordeaux bashing” during his term as President (and now in the first weeks of his second term). Every year he releases his own wine at what is widely held to be a reasonable price, but staunchly defends the pricing of the UGCB’s members, as is his political wont.

Other speakers were more vocal. Millésima’s founder, Patrick Bernard, underlined the importance of understanding that “People won’t buy en primeur unless they can hope for an appreciation in the price.” Fine Wine Buyer for Berry Bros. & Rudd, Max Lalondrelle, observed, “We’re asking a huge amount of our clients; we’re asking them for nearly ten years of financing for a product, so we must give them something.”

He couched this with some positive news for the region: “The strength of Bordeaux is that clients are always going to buy Bordeaux.” The conference went on in this manner, each speaker sending balanced but clear messages about the predicament facing Bordeaux — and its en primeur system. The frustration came toward the end, when it was clear that nobody was going to propose a solution, and the assumption seemed to be that the 2015 vintage alone would rescue the situation.

Indeed, early April flights from Gatwick to Bordeaux were fuller than ever with the red trousers of the wine trade on tour. Positive reports of the 2015 vintage undoubtedly translated into high attendance by the Brits at this year’s annual en primeur tastings, after dwindling interest over the past three years. Smaller merchants, such as Richard Dawes Fine Wine, decided 2015 was worth the trip after skipping the past few vintages, while Nicholls and Perks sent a “much increased taskforce.” Meanwhile the Asian contingent seemed less prevalent than a few years ago, but the American presence was decent.

What price?

The trade as a whole is painstakingly trying to balance caution and exuberance. The former is required to stay price rises from Bordeaux, and the latter to enthuse customers and avoid a fifth consecutive damp squib of a campaign. Most are realistic enough to anticipate — and indeed to support — modest price rises compared to 2014 release prices.

A trade survey undertaken by Wine Lister asked what average price adjustment would be appropriate “for crus classés and equivalent,” by canvassing the opinion of more than 40 key players, between them representing more than one third of global fine-wine revenues. The answer was an increase of 3 percent.

This is without a doubt an unrealistic hope on the part of the global wine trade. It reflects the fact that 39 percent of respondents believed there should be no change on 2014 prices, with 17 percent pushing for a decrease. However, among those who accepted that a price increase would be appropriate “in the context of what is being hailed as the best vintage since 2010,” the average increase suggested was 12 percent.

Tellingly, when analyzing the views of the different respondent types, by far the highest (and therefore probably most realistic) suggested average price change was put forward by eight of the largest, top-tier UK merchants, at 9.4 percent — despite the weakness of sterling. Somewhere in this range (9 to 12 percent) is more likely, and anecdotally I have heard producers who want to increase prices by significantly more.

Baptiste Guinaudeau of Château Lafleur said at an Armit Wines tasting of his 2015s in London on April 21, “I hope it will be the first ‘great’ vintage at a ‘normal’ price since 2005.” He explained he thought prices would have to be higher than 2013 and 2014, but lower than 2009 and 2010. “We’re going to try not to do anything stupid,” offered François-Xavier Borie, owner of Grand-Puy-Lacoste.

One or the same

Without doubt, some very great wines were made in 2015. Alexandre Thienpont at Vieux Château Certan (opulent, elegant, profound) was palpably excited, exclaiming proudly, “At last, a wine.” Stéphane Derenoncourt believes his own wine, Domaine de l’A (poised, piercing, pure) is the best he’s ever made in 2015. Neither was exaggerating. The team at Cheval Blanc (sensual, carnal, enthralling) were so pleased with the homogenous quality of their harvest that they felt no need to make a second wine, and “very homogenous” was also how Olivier Berrouet described the vintage at Petrus (deep, ethereal, suave).

These standout cases aside, the vintage has been labeled rather as heterogeneous, by which most commentators mean that the quality is not consistent across the board. A more positive application of the word would be to the style of the wines and not their quality. One of the most exciting aspects of the vintage is that it doesn’t mask the character of each terroir, the style of each cru. The diversity — or heterogeneity — of 2015 may be precisely what makes it wonderful.

“Identitaire” is how Derenoncourt describes the vintage. This hits the nail on the head. There is no direct translation into English, but I take it to mean “identity-giving.” Cyril Thienpontof Pavie-Macquin concurs: “I think it is a vintage when each château is very easily identified,” explaining that as winemakers, “we’ve signed-off on the terroir.” He adds that this characteristic will also mean that “each château will have its own level of success.”

In a more homogenous vintage, such as 2009, the quality level might be more consistent, but the style of the wines is also more homogenous, with the characteristics of the vintage often shining more brightly than the character of the cru. In 2015, if the quality is less consistent, the upside is that each terroir can sing out loud. Derenoncourt took this concept of giving identity and ran with it, presenting the stable of wines for which he consults in a series of flights organised by soil-type. The argilo-calcaire (clay-limestone) plateaux shared a real sense of energy, “something we don’t always have on [these soils],” said Nicolas Thienpont, lauding the “freshness” of 2015.

Vintage association

Cyril Thienpont, Nicolas’s son, likes the sunny style of 2009, and he believes 2015 shares some of the suavity and ease of that earlier vintage. Comparisons to other vintages came less easily for 2015, with characteristics taken from here and there. Derenoncourt observed, “The last vintage to have the same quality was 1989 — powerful but naturally so, not tiring to taste — with beautiful maturity but fresh, too.”

Most are saying the vintage is not at the level of 2009 and 2010, but Mathieu Chadronnier, managing director of négociant CVBG, believes that in some cases the wines are “better than the winemakers admit.” He thinks reluctance to compare is “mainly because 2015 is not as concentrated,” which for Chadronnier is not a negative point. “2015 reminds me of the textbook seductive vintage — ’85,” he says, clarifying, “not everybody realizes it’s a truly great vintage, but all the wines are delicious 30 years on.” Château Margaux’s technical director Sébastien Vergne was not afraid to make comparisons with the last three “great” vintages, saying 2015 “has the finesse of 2010, the power of 2009, and the tannins of 2005.”

Charles Chevallier — until recently technical director at Château Lafite-Rothschild, and now senior advisor — was also “more or less persuaded” that 2015 was “in this category of great wines, but probably with more freshness.” The grand vin at Lafite is around 12.7% ABV, “which allows an expression of Cabernet Sauvignon grapes that are ripe without being overmature, so they’ve kept an aromatic freshness that is very beautiful,” explains Chevallier. The ease with which the wines were made reminds him of 1996, whereby “from the first day of vinification we saw there was a natural extraction, so the cellar hands were more or less idle.” He adds that at first, pumping over was necessary to start the process, but they very quickly reduced this to just two times per day, and only one third of the contents of the vats, “so as not to force the extraction.”

On the Right Bank, Petrus winemaker Olivier Berrouet recounted a similar story. “There was strong tannic and alcoholic potential, so we thought we’d do a short fermentation but in actual fact it lasted longer, but without too much extraction,” he explained, adding that “after 12 days we didn’t move the vats anymore.”

Word association

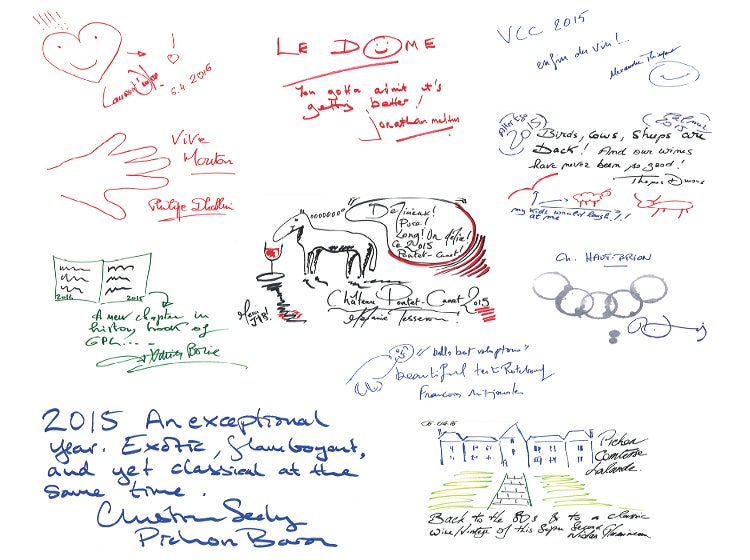

During my five days in Bordeaux, I asked the winemakers to name one characteristic that defined the vintage for them. (London-based fine-wine shipper and merchant Justerini & Brooks had the same idea, kindly sharing above the descriptions and sketches they received from owners and winemakers.) Alexandre Thienpont chose “complete. “Chadronnier agreed, saying the 2015s “don’t lack anything”, adding, “there’s no ‘but’ this year.”

Château Pavie’s owner, Gerard Perse, plumped for “exceptional.” François-Xavier Borie chose “purity.” Chevallier couldn’t settle on one word, and went for “elegance and finesse.” Elegant appeared on numerous occasions, for example in Frédéric Engerer’s paean to the quality of the fruit in Château Latour’s 2015: “crunchy, generous, expressive, elegant.”

The weather

None of this was given, when in July 2015 vines were close to shutting down in the heat and drought. The summer of 2015 was touch and go. As Bordeaux merchant Bill Blatch reported in his annual vintage report, in July “the roadsides started looking like savannah,” and there were “forest fires blazing” near the southwest suburbs. Then the rains came. “August saved the vintage, and September and October made the vintage,” pronounced Olivier Bernard.

When I visited Domaine de Chevalier in late September, Bernard, like many others, rode out a day or two of rain to pick at leisure into October. After experiencing half its usual rainfall in May, June, and July, then double the norm in August, Pessac-Léognan reverted to half the norm again in September and October. Other corners of Bordeaux were not so lightly spared, notably St-Estèphe, though some in the appellation coped very well. Most of Bordeaux experienced a relatively relaxed harvest. Consultant Michel Rolland confirmed, “We had time; there was no pressure through the harvest.”

The climate

“If Parker were here it would be a good advantage for Bordeaux,” asserted Rolland, alluding to the wine critic’s influence in making or breaking a Bordeaux en primeur campaign until he handed over the reins to Neal Martin. Edouard Moueix of Etablissements Mouiex likewise observed, “Bob is not here so no-one is omnipotent anymore,” concluding “There won’t be the shot at the start of the race.” Moueix thinks this could lead to a more drawn-out campaign, perhaps lasting into early July. Guy Seddon, Corney & Barrow’s Private Sales Executive, even wondered if the absence of Parker had contributed to the style of the vintage, saying, “perhaps the lightness of touch signals a drawing to a close of the monolithic Robert Parker era.”

Parker or no, early or late, light-touch or otherwise, without a doubt, prices will increase on 2014. Michel Rolland insisted that “the market makes the price,” saying neither properties nor négociants control it. This is not, of course, the case for en primeur releases, where the only determinant of the price is the château, with less influence from La Place de Bordeaux than in the past.

When asked if 2015 was going to be the vintage that turns things around for Bordeaux, négociants and importers alike replied in the negative, usually qualifying this with some more hopeful language. “It will be one of the good opportunities for Bordeaux to find its way back to the consumer,” said Moueix, “first through quality, and hopefully through prices.” On the latter, Moueix doubts that prices can meet expectations. “The market always expects lower prices than would be fair, and the châteaux higher prices than would be fair, so whatever happens the market will be disappointed,” he predicts.

All stocked-up

Referring to pricing, Gérard Sibourd-Baudry, managing director at Paris’s Caves Legrand, told me “I dare to hope that the châteaux won’t screw it up.” He continued, “Bordeaux is the only viticultural region with prices that rise and fall according to the vintage, but there are no more bad vintages, so the consumer doesn’t understand or accept this anymore.” He added that, from the perspective of wine merchants, “our cash flows are fragile, with 2011, ’12, and ’13 still in stock.” Sibourd-Baudry reeled off a bevy of unfavorable macroeconomic factors to finish his argument for sensible pricing with a flourish — including “Brexit, US elections, and Chinese anti-corruption.”

The Bordeaux merchants are more measured — no wonder, given their symbiotic relationship with the châteaux — but Chadronnier is a négociant who has been less shy than some in telling the situation as it has been in recent years. “We did have a little more stock left in 2011-2014,” he said, carefully. He also told me, however, that the Bordeaux trade is “unarguably optimistic” about the campaign, and he believes it will be a long one, starting early and finishing late. In the context of a successful campaign, historically négociants have held back significant stock to sell at a higher price later, but “there’s no point holding back more stock if we want to keep en primeur alive,” observed Chadronnier — language that suggests that the united front of La Place is not taking en primeur’s resuscitation for granted?

One brush

Chadronnier believes that, more than ever, the campaign’s success will be “much more down to brands and categories”. He argues that “value wines” must be treated differently from the crus classés. “Prices are going to be tricky, because some wines may increase by €1, and that may be 15 percent on a very modestly priced wine,” he explains, adding that CVBG will be buying a broader range of wines for stock this year, which will include some of the value wines. This is a low-risk strategy because these wines experience no price volatility; they cost what they cost, and are not the object of speculation. Chadronnier adds that these wines have a bigger market than the expensive crus.

Nicolas Thienpont similarly believes that this category should be considered separately. “Bordeaux bashing is a real problem, but to extend it to wines that sold gross for under €10 per bottle — it scandalizes me,” he exclaims. He accepts, however, that in 2010 “The châteaux collectively speculated,” and as a result “many of the trade still have stocks of 2010 that are not with the final consumers, causing congestion in the trade for subsequent vintages.” Thienpont is hopeful that “there won’t be speculation like in 2010,” and that “wisdom” will prevail. “The properties must not be exuberant in their pricing,” he advises.

FX effects

Louis de Baritault, export manager at négociant Duclot, points out “You can’t have a successful en primeur campaign that doesn’t work in the UK.” The Brits are “showing interest,” says de Baritault, and they were certainly out in force to taste, but in the light of the weak pound, are they interested enough? “We were already staring down the barrel of a 10 percent price increase on exchange rates alone,” cautions BI’s Giles Cooper, concerned that “there doesn’t seem to be any appetite to hold last year’s prices, let alone reduce them.”

“The exchange rates are a worry, but the attitudes of the Bordelais are an even bigger worry,” quipped Oliver Bartle, fine wine trader at Roberson. The Pound has been weakening against the Euro since the beginning of December last year, which, simply put, means it costs more for British importers to buy French wine. This is largely down to the upcoming “Brexit” vote, and uncertainty about what a British exit from the EU would mean for the British economy.

A vote to remain would be likely to reverse the trend, so savvier UK consumers may wait until after June 23 when they will get more pop for their Pound, slowing down the whole campaign. “As a merchant I’m going to protect myself,” says Baudouin Cuchet, director of Fine and Rare Wines, who will take out a forward contract to fix a rate. He points out, “We have this dilemma every year, it’s just that at the moment there’s much more uncertainty than usual.”

Captive audience

On the flight back from a tiring week’s tasting in Bordeaux, I had my pick of UK merchants to sound out. There was much positivity shining through the bleary eyes. “We’ve had powerful experiences with a lot of wines, that we want to take to our clients,” enthused Cooper, assuring me, “more than ever we want to be positive.” This optimism was colored, however, with caveats.

“I think the highs are very high, though not uniform,” summarized Chadwick Delaney, managing director of Justerini & Brooks. He believes it’s down to the producers to make the campaign work now. “This vintage should be used by the estates to bring people back to Bordeaux, not for squeezing the last Euro,” he warns. “The bigger prize is to bring Bordeaux back to pre-eminence,” he declared.

Delaney reported that as J&B delivered this message from château to château, everyone seemed to understand, “with one notable exception.” There has been a tendency in the past, on the part of the producers, to appear to understand the pricing dilemma in relation to Bordeaux as a whole, but to feel their wine is somehow an exception. I heard fewer justifications or excuses this year.

Delaney advises châteaux “not to worry about what your neighbor does but what the customer will do.” There has been some consternation in Bordeaux about the Brits offering advice, or “bashing” Bordeaux (culminating in the open letter sent in January 2015). The British trade, however, feels it is its prerogative, as BI buyer Oliver Sharp explains: “Quite rightly we feel we have a share in Bordeaux. We dedicate three months of our year to the region — three months where our company and the whole trade is in limbo waiting for the châteaux and the Place to mobilize and set the campaign in motion, and during that time we are all in thrall to their whims. It makes it difficult to sell any other wines while all our communications are around en primeur, and all our customers have a psychological budget. No other region receives that privilege.”

DNR?

The large British merchants have not quite given up on en primeur yet, but neither should their interest and input be taken for granted. Delaney is hopeful for a “very good campaign,” implying that for J&B it should be bigger in revenue terms than the past four. Nonetheless, gone are the likes of 2009 and 2010 — “There isn’t the demand and there won’t be the supply,” he says, referring to the increasing number of châteaux keeping back a substantial amount of inventory.

Adam Brett-Smith, managing director of Corney & Barrow, is even more dismissive, saying “Commercially, en primeur has become almost irrelevant.” He underlines the risks merchants take with the decisions they make “on behalf of customers,” which “will come back to bless us or haunt us in the years to come.”

Bartle believes there’s still time to bring en primeur back to life, and it’s as simple as price: “If the system works again, our clients will care about en primeur again.” He stressed: “If there’s a year for it to work, this is the year.”

Catalyst for change

I’ve argued in these pages for the past few years that the way La Place protects the producers makes it very hard to instigate change. “There’s a fear factor that as a négociant you’ll lose your allocations,” agrees Sharp. This essentially means the châteaux can sell their wine at a price not supported by the end market, and the négociants will take the hit if they can’t sell it on.

So, what will it take to shake off the It inertia? does feel as though there is a more widespread realization that La Place cannot bear the brunt forever, and that Bordeaux’s reputation and sales are suffering more generally. Ultimately, the majority of Bordeaux producers are reliant on La Place, and on the en primeur system, and they seem to be coming round to the idea that they need to act together to save the system. “We’re not selling 1ha of Burgundy, we’re selling 80ha (300,000-400,000 bottles),” notes Nicolas Glumineau, general manager at Pichon Longueville Comtesse de Lalande, continuing, “I need a sales team behind me, and I want to stay in the en primeur system.”

There have been glimmers of light for en primeur. The 2012 vintage has proved the en primeur system can still work for consumers. The vintage — which was pleasurable to taste en primeur, but which suffered from a general disillusionment with the region and its pricing — has been flourishing recently and seems to be undergoing a wide reassessment. Some producers went to considerable lengths to reconnect with customers last year as well, and Delaney believes, “The prices at the heart of 2014 were good.” He concludes, “I hope the majority get it right in 2015.” Don’t we all.

Ella Lister is Founder & CEO of www.wine-lister.com